Resolution Team —

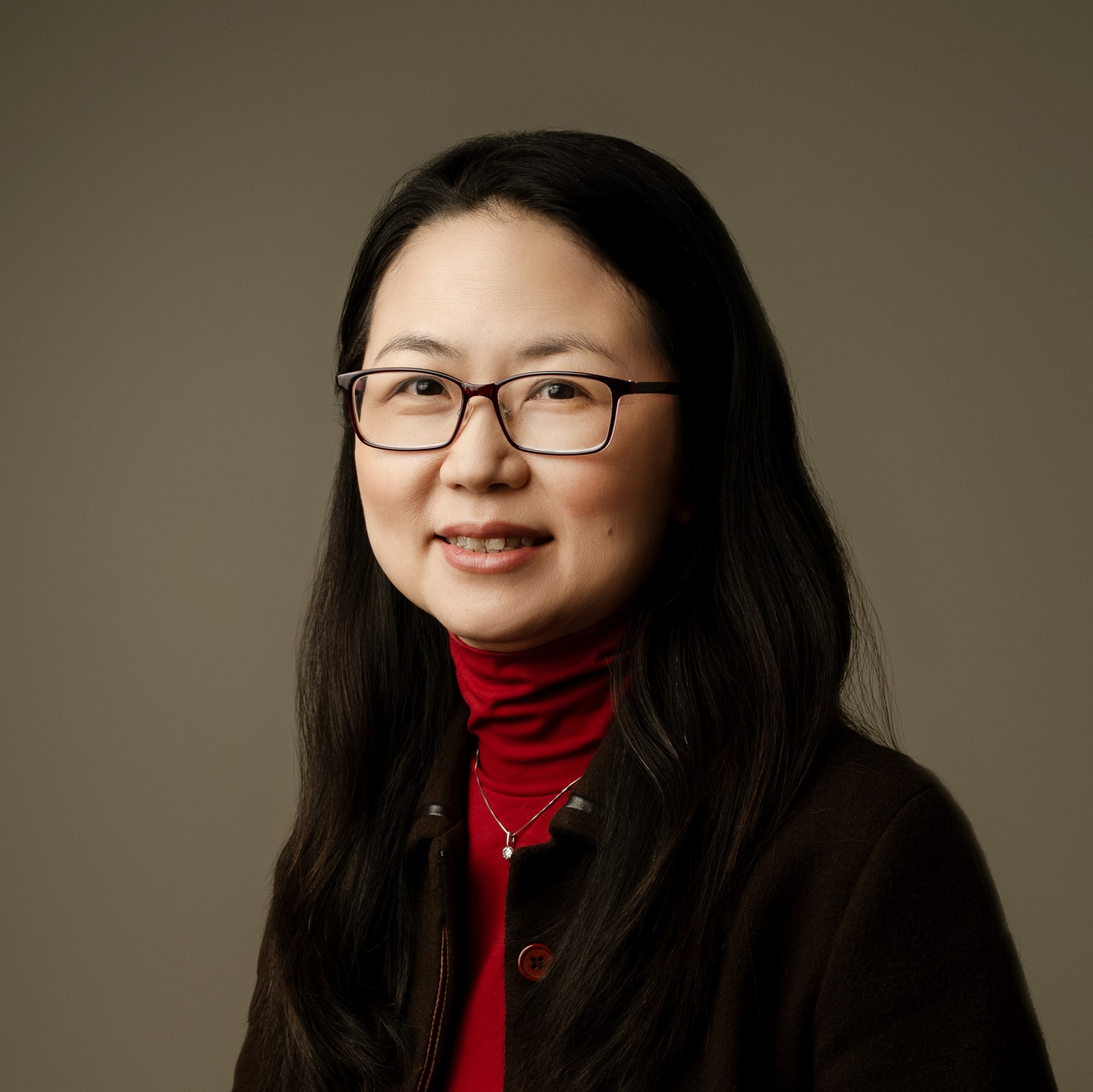

Connie Huang, EA

Professional Experience

- IRS Enrolled Agent with deep expertise in tax compliance, strategy, and IRS representation.

- Tax Resolution Consultant with 5+ years of experience resolving IRS issues for individuals and businesses.

- Founder & CEO of SE Tax Relief – providing tailored tax resolution solutions to help clients achieve financial freedom.

- Co-Founder & Partner of JY Tax & Accounting Services – leading a team that serves 400+ business clients and 1,500+ individual clients with tax preparation, payroll, bookkeeping, and advisory services.

- 10+ years of experience as a Hedge Fund Accountant, specializing in capital gains/losses reporting and stock market tax strategies.

- Recognized for delivering personalized financial solutions, building long-term client relationships, and leading high-performing teams.

Education

Bachelor of Science in Accounting & Master of Accountancy Tax Concentration, University of North Carolina at Charlotte

Certification

Enrolled Agent, IRS

Operating Team —

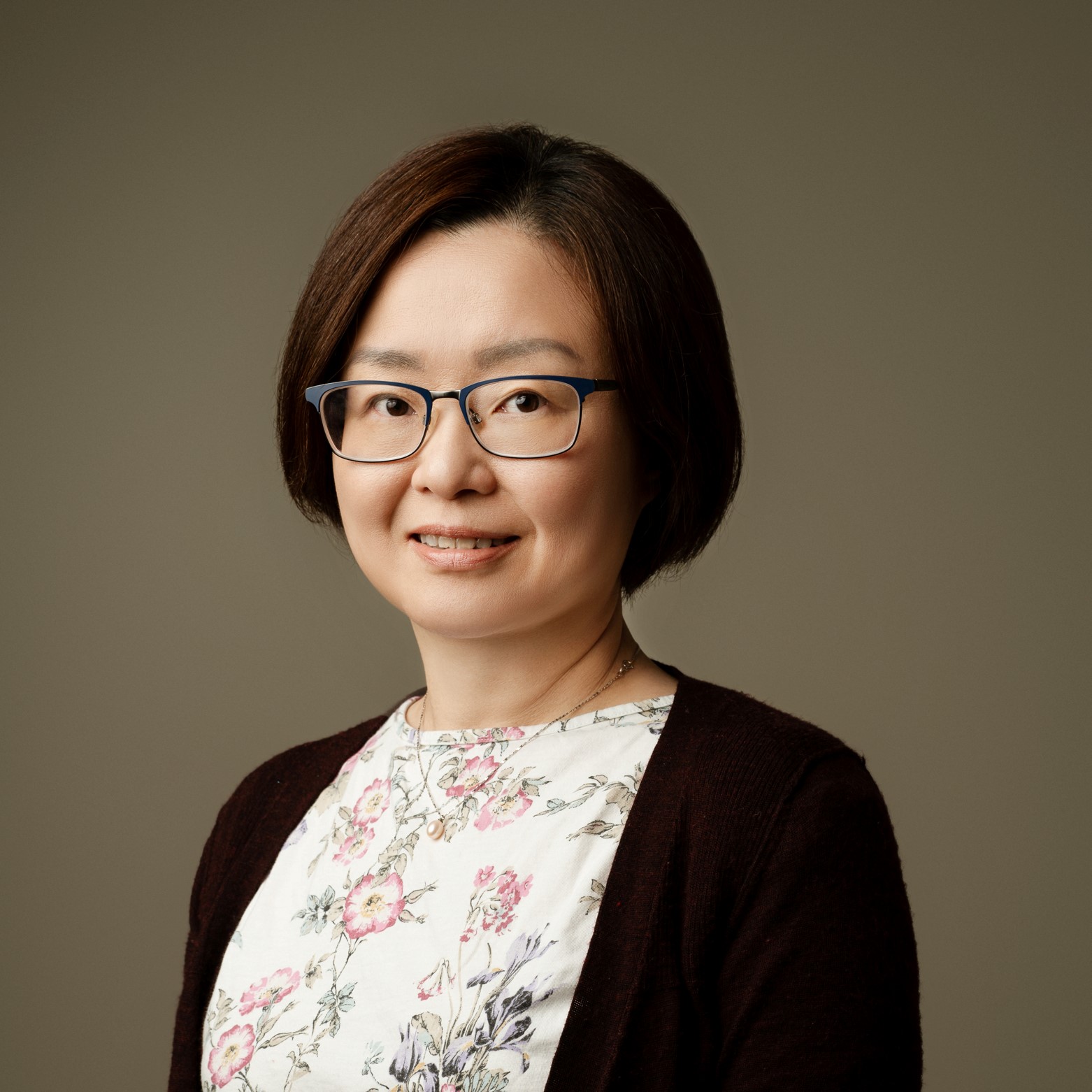

Jane Sun

Professional Experience

- Co-Founder & Partner of JY Tax & Accounting Services – leading a team that serves 400+ business clients and 1,500+ individual clients with tax preparation, payroll, bookkeeping, and advisory services.

- Specializes in Accounting Analysis & Financial Reporting, Payroll Tax Compliance, Sales & Use Tax Reporting, and Real Estate Tax Reporting.

- Oversees operational performance for clients in the restaurant and accommodation industries, optimizing financial systems and tax structure.

- Leads cross-functional teams to deliver high-impact advisory services tailored to hospitality businesses.

Education

Bachelor of Science in Accounting & Master of Accountancy Tax Concentration, University of North Carolina at Charlotte

Jennifer Hu

Professional Experience

- Joined J Y Accountants in 2021, bringing extensive expertise in tax and financial operations.

- Specializes in Accounting Analysis, Financial Reporting, Payroll Tax Compliance, Sales & Use Tax Reporting, and Real Estate Tax Reporting.

- Provides tailored accounting solutions across diverse industries, with a focus on accuracy and regulatory compliance.

- Collaborates with clients to streamline tax processes and enhance financial transparency.

Education

Bachelor of Science in Statistics, Xiamen University

Ivy Yang

Professional Experience

- Joined J Y Accountants in 2021, contributing specialized expertise in small business taxation and financial analysis.

- Focuses on Accounting Analysis, Federal and State Tax Filing, and Tax Reporting for Small Businesses.

- Provides tailored tax solutions and compliance support to entrepreneurs and growing enterprises.

- 2 years of auditing experience at a public CPA firm.

- 3 years of accounting experience at one of the world’s largest construction companies.

Education

Master of Science Accounting, Hofstra University

Bachelor of Science in Finance, Ocean University of Shanghai

Joanna Zhong

Professional Experience

- Joined J Y Accountants in 2022, contributing strong foundational expertise in tax and financial reporting.

- Specializes in Financial Reporting, Payroll Tax Compliance, Sales & Use Tax Preparation, and Real Estate Tax Reporting.

- Supports clients with accurate filings and regulatory compliance across various industries.

- Worked with a trading company, assisting in financial documentation and transaction analysis.

Education

Bachelor of Science in Accounting & Master of Accountancy Tax Concentration, University of North Carolina at Charlotte

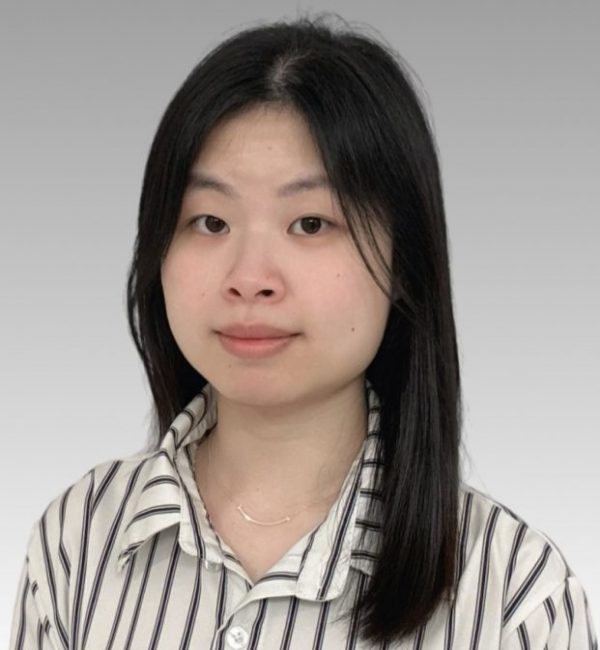

Emily Lu

Professional Experience

- Joined J Y Accountants in 2024, quickly establishing herself as a reliable and detail-oriented bookkeeping professional.

- Specializes in monthly bookkeeping services for small and mid-sized businesses.

- Key responsibilities include preparing accurate and timely financial statements and filing monthly sales and use tax reports, processing payroll for clients across various industries, and managing payroll tax filings and compliance.

- Supports clients in maintaining clean financial records and meeting regulatory deadlines with precision.

Education

Bachelor of Science in Accounting, Arizona State University

Administration —

Fandy Cheuk

Professional Experience

- Joined J Y Accountants in 2021 as a versatile and results-driven operations executive.

- Brings extensive hands-on experience in business administration across academic and consulting environments.

- Proven track record in:

• Contract administration and vendor management

• Budget control and financial oversight

• System review and operational streamlining

• Efficiency improvement and workflow optimization

• Policy development and implementation

• Marketing strategy for university-based consulting and training programs - Supports cross-functional initiatives to enhance organizational performance and client service delivery.

Education

Master of Business Administration, City University of Hong Kong

Master of Arts in Quantitative Analysis for Business, City University of Hong Kong

Bachelor of Science in Industrial Engineering, University of Hong Kong